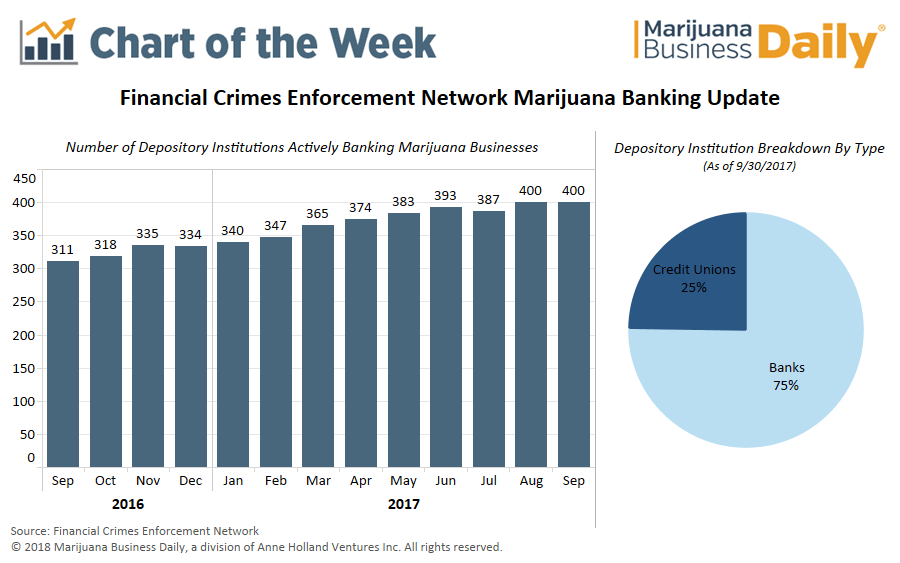

The number of banks and credit unions actively serving the marijuana industry has jumped nearly 30% from a year ago.

But U.S. Attorney General Jeff Sessions’ decision to repeal the Cole Memo may prevent further involvement by banking institutions looking to work with cannabis-related businesses.

Joint memos issued by the U.S. Justice Department and Treasury Department in February 2014 spurred the increased access to banking services, as they provided banks with a much-needed framework for how to work with clients in the marijuana industry.

Generally speaking, the memos require financial institutions to verify that marijuana companies are properly licensed by the state and to monitor any financial wrongdoing and report suspicious activity to regulators.

However, many banks and credit unions are wary of working with cannabis businesses.

Marijuana remains illegal under federal law and the risk – no matter how small – of losing a federal license or incurring some other punishment has proved too much for most financial service providers to stomach.

Although banks and credit unions serving clients in the marijuana industry are not directly affected by the scrapping of the Cole Memo – they operate on completely separate guidance from the Justice and Treasury departments – the decision has further muddied the waters in a situation that was unclear to begin with.

Here’s what you need to know:

- Combined, there are over 11,000 banks and credit unions operating throughout the United States, meaning less than 4% of U.S.-based financial institutions are serving marijuana businesses. Many banks that do provide services to cannabis companies prefer to keep quiet about it, however, making it especially difficult for marijuana businesses to find a financial services provider.

- Financial institutions that knowingly provide banking services to cannabis businesses often charge a premium for their services. A cannabis business in Maryland recently reported paying monthly fees in excess of $1,700 to use a local bank.

- Sundie Seefried – CEO of Partner Colorado Credit Union and architect of the institution’s Safe Harbor Private Banking program – said that of all the institutions looking to license their proprietary cannabis banking compliance software, the smallest managed about $100 million in assets. Less than 30% of U.S. credit unions manage more than $100 million in assets, helping explain why banks account for the vast majority of depository institutions that serve the marijuana industry.

Eli McVey can be reached at [email protected]