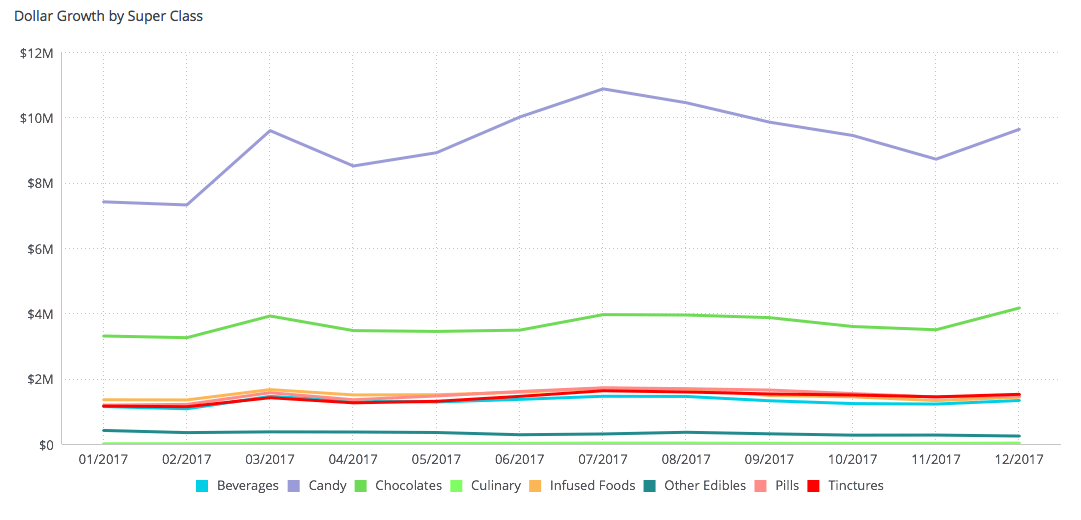

Edibles Sales Strong for 2017, But Growth Declined

Colorado’s edibles market hit $227.5 milion in sales during 2017, representing 21 percent in growth — a strong year, but growth fell back from 53.5 percent during 2016 according to data from cannabis market research firm BDS Analytics. Just as happened first with flower, we now are witnessing a bit more maturity in the edibles market. The market continues to expand at a rapid pace, but given its large size compared to 2014, when recreational sales began, achieving spectacular growth of 50 percent or more is unlikely.

The marketplace, however, remains fizzy with brand competition.

Brand Competition Fizzy For Edibles Products, Especially CBD

The top 10 products, in terms of sales, are divided between five different brands. One of the brands sells four of the leading products; another sells three; and the rest are divided between three additional companies.

Competition is even more fierce between brands, however, when we examine edibles products that are only high in CBD, a marketplace that last year saw sales of $37.3 million and growth of 66 percent. When we study that slice of the edibles pie, we find products from seven companies filling the top 10 list, with products ranging from patches to pills to gummies, chocolates and tinctures.

Among the types of edibles products, competition for market share between brands in some cases is like a cage match between just two fighters. In other markets, it’s more like a street brawl.

For example, two companies divvy up the candy marketplace top 10, in terms of sales of individal products. The same goes for the chocolate market. But three brands for now divide the infused foods market (infused foods are normally baked goods like brownies and cookies) top 10. And the battle for top 10 product sales in the tinctures and beverages markets is being waged between four companies within each market.