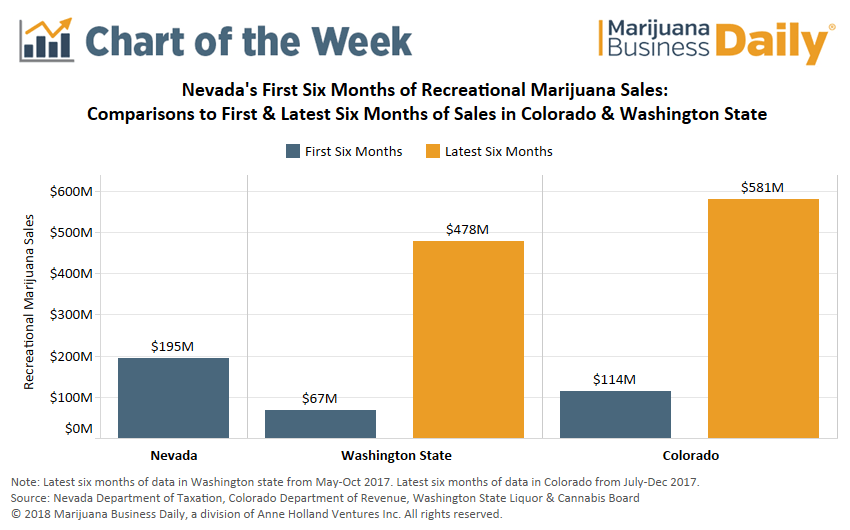

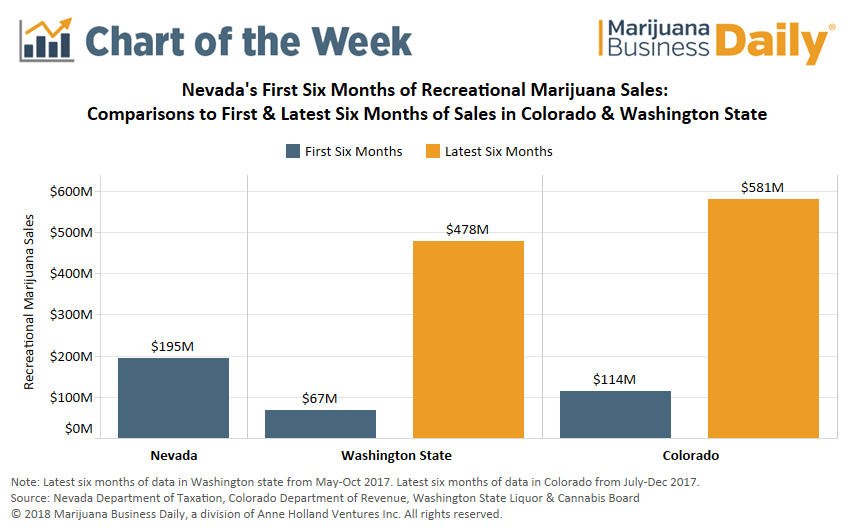

Nevada retailers sold nearly $200 million worth of recreational cannabis since adult-use sales began six months ago, surpassing the total revenue generated by Colorado and Washington state in the early months of their recreational markets.

Nevada’s higher sales totals relative to other adult-use markets are driven by several factors:

- Nevada’s early start program – which allowed licensed dispensaries to sell recreational marijuana while final rules for the adult-use program were ironed out – proved extremely successful. Despite initial hurdles regarding cannabis distribution licenses, the state was generally well prepared to handle the influx of new recreational customers.

- Over 40 million visitors travel to Las Vegas each year, many of whom visit the city primarily for vacation or leisure purposes.

- Today’s cannabis industry is very different than it was in 2014, when Colorado and Washington state launched adult-use sales. Branding and retailing practices have advanced significantly, and stores now offer a larger assortment of products that appeal to both new and experienced consumers – such as low-dose edibles and high-potency concentrates – that weren’t widely available in rec markets just a few years ago.

Currently, average monthly sales in Nevada are just over $32 million, while Colorado and Washington state’s average monthly sales over the latest six months of available data are $96.7 million and $79.7 million, respectively.

Whether rec sales in Nevada will grow as dramatically remains to be seen and will depend on how certain aspects of Nevada’s market develop.

A few things to consider:

- The number of retail stores allowed in Nevada will be based on a county’s population, with initial estimates suggesting this will be around 130 statewide – fewer stores per capita than any other recreational market. Washington state and Colorado have each issued over 500 adult-use retail licenses.

- Rec sales in Nevada have yet to rise in two consecutive months. This suggests the market, as expected, is fueled by tourist spending. In Colorado and Washington state, in-state residents form the bedrock of the adult-use customer base. Tourists have different product preferences and spending habits than local customers, making it more difficult to predict how adult-use spending will progress in the coming years.

Eli McVey can be reached at [email protected]